IPv4 Transfer Market: How Does It Work and Is There an Alternative?

Uncover the ins and outs of the IPv4 transfer market, how it operates in different regions and what the best alternative to transferring IPv4 addresses is.

IP addresses – or Internet Protocol addresses – are numeric and alphanumeric labels associated with internet-connected devices. There are two main versions of the IP currently in use: IPv4 and IPv6. IPv4 addresses are numeric identifiers, such as 88.168.1.1, while IPv6 addresses are alphanumeric and look like this: 2001:4a60:4d60::88f8. In this article, we focus on the former version of the IP and, more specifically, how the IPv4 transfer market works.

If you did not know that IP addresses, simply referred to as IPs, are transferable, and you have no clue as to how the process works, this article gets down to the nitty-gritty to explain it all. We also look at the role of IP transfers in the wake of IPv4 exhaustion and evaluate if IP lease providers can offer an alternative.

What is the IPv4 transfer market and how did it emerge?

IP addresses are intangible assets, which is why it might be difficult to understand how they can be moved around, so to speak. Of course, IPs are not physically transferrable, and, in fact, they cannot be owned. Therefore, when we talk about transferring IPs, we are actually talking about transferring the rights to use those IPs.

As you probably know, communication online would not be possible without IP addresses. This is what makes them an essential component of the internet. However, there aren’t enough IPs to go around. Of course, we have more than plenty of IPv6 addresses – 340 undecillion. However, these IPs are not yet in full deployment, and the internet is mostly built on IPv4 addresses. Sadly, there are only 4.29 billion of them.

When IPv4 emerged in the 80s, 4.29 billion seemed like a number big enough to support internet-connected devices for many years to come. Due to that, IPs were allocated without considering the idea of exhaustion, which finally took place in February 2011. That is when the Internet Assigned Numbers Authority (IANA) – an organization responsible for managing IP resources – allocated the last /8 IPv4 blocks to Regional Internet Registries (RIRs).

Slowly but surely, the IPv4 transfer market started taking shape.

The beginnings of the IPv4 transfer market

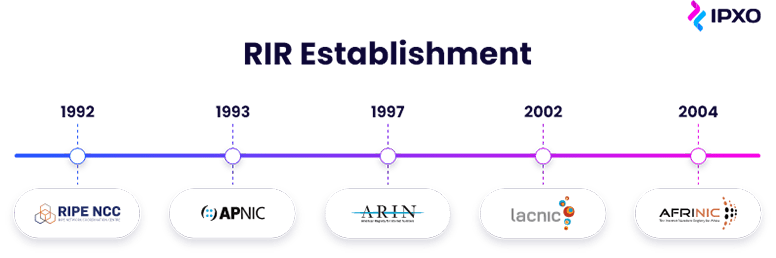

It is important to define two types of IP transfers: intra-RIR and inter-RIR transfers. Needless to say, intra-RIR transfers occur within a region, while inter-RIR transfers occur between regions. The first intra-RIR transfer occurred in 2009 when the first IP transfer agreement was organized by ARIN (American Registry for Internet Resources). This RIR has been operating in North America since 1997.

The first intra-RIR transfer created a precedent for transferring the rights to the registration records of IP addresses. A few years later, ARIN and APNIC (Asia Pacific Network Information Center) performed the first inter-RIR transfer.

So, how does this work exactly? Every RIR has its own policies pertaining to IP resource transfers. Interestingly, only APNIC, ARIN, RIPE NCC (Réseaux IP Européens Network Coordination Center) and LACNIC (Latin America and Caribbean Network Information Center) participate in inter-RIR transfers. At the time of publication, AFRINIC (African Network Information Center) only performed intra-RIR transfers.

Essentially, IP transfers are deals between IP holders transferring resources and organizations receiving resources. RIRs stand in the middle of these deals because they are responsible for managing the registration records.

Soon after IANA exhausted its pool of free IP addresses, the IPv4 transfer market started accelerating. Just a few months later, in April 2011, Microsoft bought 666,624 IPv4 addresses from Nortel. Along with that, the right to use and transfer these addresses as the company pleased.

Microsoft paid $7.5 million for the IPv4 resources, which put the value of a single IP address at $11.25. Ever since then, IP brokerages have been popping up, and the IPv4 transfer market has been booming. Everyone from hosting companies to cloud providers and data centers to e-commerce businesses has participated actively.

How does the IPv4 transfer market operate across RIRs?

The IPv4 transfer market is based on policies that the Regional Internet Registries introduce to their members. Let’s look at how different RIRs organize IPv4 transfers.

AFRINIC transfer market

Based on the IPv4 Intra-RIR transfer policy, AFRINIC members are eligible to organize transfers within the region.

Main requirements for the transferring organization:

- Must be the rightful owner of the resources

- Cannot request IPv4 allocations or assignments for a year after the transfer’s approval

- Must not have received IPv4 resources from AFRINIC within the past year

Main requirements for the recipient organization:

- The recipient must justify the need for IPv4 resources

- Must be an AFRINIC member and sign the Registration Services Agreement

- The organization accepts that legacy resources lose the legacy status after the transfer

At the time of research, AFRINIC had 1,558,528 IPv4s available and 4,076,800 IPv4s reserved. Most of the IPs (/24s) were allocated to ISPs (internet service providers) and telcos – 59.65% and 26.66%, respectively.

APNIC transfer market

APNIC and ARIN were the first two RIRs to organize an inter-RIR transfer in 2012. It is safe to say that APNIC has extensive experience when it comes to transferring IP resources. According to the APNIC IPv4 Transfer policies, transfers are eligible between:

- APNIC account holders (intra-RIR transfer)

- APNIC account holders and organizations in other regions (inter-RIR transfer)

- Historical IPv4 address holders

- Organizations that participate in mergers, acquisitions or takeovers

Both inter- and intra-RIR transfers are limited to the minimum transfer size of /24 (256 IPv4s). Furthermore, according to the APNIC policies, IPv4s delegated from the 103/8 pool are not transferrable for five years from the original delegation date.

ARIN transfer market

According to John Sweeting, CCO at ARIN, the registrar started preparing for a transfer market long before its pool of IPv4 addresses depleted in September 2015. The ARIN transfer market emerged in 2009 with the first intra-RIR transfer.

The transfer market operates in adherence to strict Transfer policies.

Main requirements for the transferring organization:

- Must be the rightful owner of the resources

- The organization must not be involved in disputes related to the status of resources

- Must provide a signed Officer Acknowledgement Letter

- Cannot have received resources from ARIN within the past year

- Finally, it cannot request resources three years after the transfer date

Main requirements for the recipient organization (for intra-RIR transfers):

- Must meet Specified Transfer Recipient Requirements

- The recipient cannot join the ARIN waiting list for 90 days

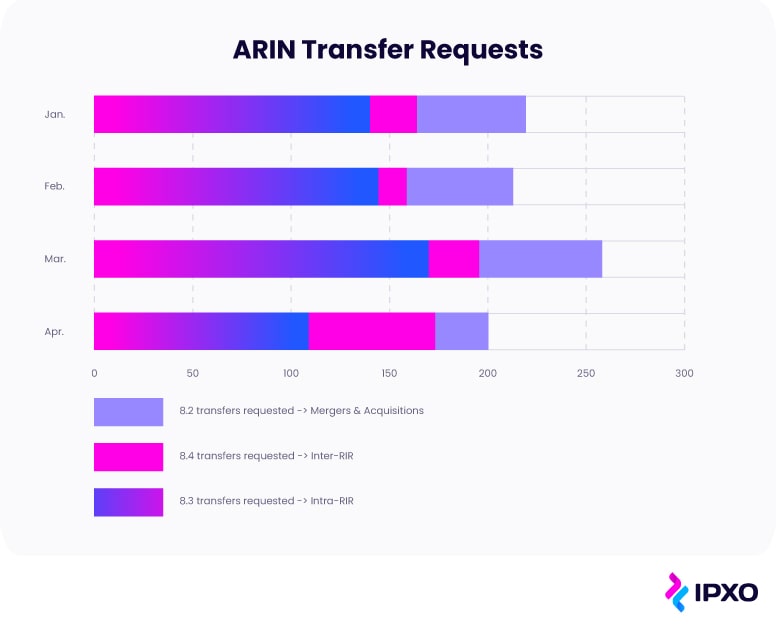

According to ARIN statistics, in April 2022, ARIN had received 73 transfer requests related to mergers and acquisitions, 19 requests for inter-RIR transfers and 108 requests for intra-RIR transfers.

LACNIC transfer market

The Latin America and Caribbean Network Information Center supports three types of transfers: transfers due to mergers, acquisitions and changes of names, intra-RIR transfers and inter-RIR transfers.

Just like the members of all other RIRs, LACNIC members that organize transfers must adhere to strict IPv4 address transfers policies.

Main requirements for the transferring organization:

- Must not be involved in disputes over resources

- Cannot ask for IPv4 allocations and assignments for a year after the transfer

- Resources cannot be transferred if they were transferred within the past year

- Allocations/assignments from LACNIC cannot be transferred for three years

Main requirements for the recipient organization:

- Must justify the need for the resources

- The organization accepts that legacy resources lose the legacy status after the transfer

At the time of research, LACNIC had 360 completed transfers between 2016-2022, of which 43 were transferred to/from RIPE NCC, 42 to/from ARIN and 1 to/from APNIC.

RIPE NCC transfer market

Based on RIPE NCC policies, allocated resources can only be transferred within the region. Provider Independent (PI) resources can be transferred to RIPE NCC members or parties that have relations with RIPE members and abide by RIPE policies.

Main requirements for the transferring organization:

- The organization cannot transfer resources if it received them within two years from RIPE, via a transfer or following a merger/acquisition

Main requirements for the recipient organization:

- Must justify the need for the resources (for intra-RIR transfers)

- The organization accepts that legacy resources lose the legacy status after the transfer (for intra-RIR transfers)

- An outside recipient must establish a contractual relationship with RIPE or a sponsoring LIR (Local Internet Registry)

At the time of research, RIPE NCC had organized 25,006 Allocated PA transfers and 5,360 Assigned PI in total between 2012-2022.

Security risks are prevalent within the IPv4 transfer market

Vasileios Giotsas, a researcher at Lancaster University, conducted a study on IPv4 transfer markets and revealed that almost 40% of all transferred resources were blocklisted. The study also revealed that autonomous systems participating in the transfer market were associated with higher levels of malicious behavior.

Transferred /24 sub-prefixes were six times more likely to be found on an IP blocklist when compared to non-transferred /24 prefixes. The researcher also found that IPs were usually blocklisted after the transfer and that parties involved in both selling and buying IPs were more likely to face blocklisting.

Additionally, according to the research, dormant IP address hijacking and spamming were some of the most common issues to follow transferred IP resources.

According to ARIN’s COO, Richard Jimmerson, the growing numbers of internet users and applications have created the perfect environment for spam, network abuse and illegal activity. He also added that making sure the entity transferring the resources has the registration rights is crucial so as to eliminate the risk of participating in illegal transfers.

Why you should consider high IP transfer costs

Transferring IP addresses is not only a lengthy and complicated process. It can also be a costly one. First, we must take into account the price of the resources. While Microsoft might have paid $11 per IP back in 2011 to buy resources from Nortel, today IPv4 prices are much higher.

IPv4.Global, one of the leading IPv4 brokers in the market, provides public access to prior sales history and ongoing auctions. At the time of research, paying $60 per IPv4 address was the new normal. At that price, a /24 block costs $15,300, a /23 block – $30,720 and a /22 block – $61,440.

Besides the raw IPv4 price, IP resource transfer deals require factoring in all kinds of charges, including fees for broker services, escrow fees and RIR fees (both membership and transfer).

Regional Internet Registry fees

| RIR | Fees |

| AFRINIC fees | – Resource (LIR) membership starts at 1,400 USD per year – Allocation fee starts at 1,750 USD (/20 block) – Transfers between two AFRINIC Resource members are FREE |

| APNIC fees | – The transfer fee is 20% of the total number of IPv4 addresses being transferred – Based on the Membership Fee Calculator, the fee starts at 1,180 AUD (/24 block) |

| ARIN fees | – The non-refundable transfer processing fee is 500 USD – Registration Service Plans start at 250 USD per service (/24 block) |

| LACNIC fees | – Both intra- and inter-RIR transfer fees start at 1,000 USD (/24 – /19 blocks) – Initial assignment fee starts at 2,500 USD for End-Users (/24 – /19 blocks) and 600 USD for ISPs (/24 – /22 blocks) |

| RIPE NCC fees | – LIR signup fee is 1,000 EUR – Annual contribution (service) fee is 1,400 EUR (must be paid before the transfer) |

IPv4 prices are climbing speedily, and the costs imposed by RIRs are high too. Therefore, anyone interested in buying IPs and signing an IP transfer agreement needs to consider all pros and cons very carefully. How many IPs do you need? How long will you use them? Will you be able to wait until the resource is transferrable again if you decide to resell IPv4 resources?

If it makes sense to buy IPv4 resources and organize a transfer, it is crucial to research the resource holder and figure out whether they have the authorization to transfer the resources. Furthermore, it is important to consider the possibility of facing blocklists and abuse prevention challenges in the future.

IPv4 transferring comes with restrictions

As you now know, AFRINIC subnets are not eligible for inter-RIR transfers, making AFRINIC the only RIR that does not participate in such transfers.

You also know that anyone transferring subnets must prove that they have the right to transfer resources to another entity legally. Entities without the right should not participate in transfers, but misuse of the IPv4 transfer market is possible, which is why all parties must be cautious.

It is also essential to keep up to date with different legal restrictions and regulations pertaining to IP resources.

For example, the EU sanctioned Russia in the wake of the war in Ukraine. Because IP addresses are an economic resource, and because RIPE NCC serves Russia, IPs are subject to EU sanctions. As a result, it is not possible to transfer or sell IPs registered to Russian entities.

Alternatives to IPv4 transferring

Businesses that plan to scale operations need IPv4 resources to support their growth. Some choose to get direct allocations from their regional registries, but not everyone is willing to wait. Unfortunately, if your company chooses to join a waiting list, you might have to put your expansion plans on hold.

Waiting lists

Currently, three RIRs provide waiting lists: ARIN, LACNIC and RIPE NCC. AFRINIC has alluded to a waiting list during the so-called IPv4 exhaustion Phase 2; however, there is no official waiting list at this time. APNIC’s abolished its waiting list back in 2019.

RIRs’ waiting lists

| RIR | # of members on the list | Waiting list information |

| ARIN | 394 | The next distribution will occur on October 3, 2022 |

| LACNIC | >700 | The wait time of the last member can reach 400 days |

| RIPE NCC | 946 | The first member in the queue has been waiting 201 days |

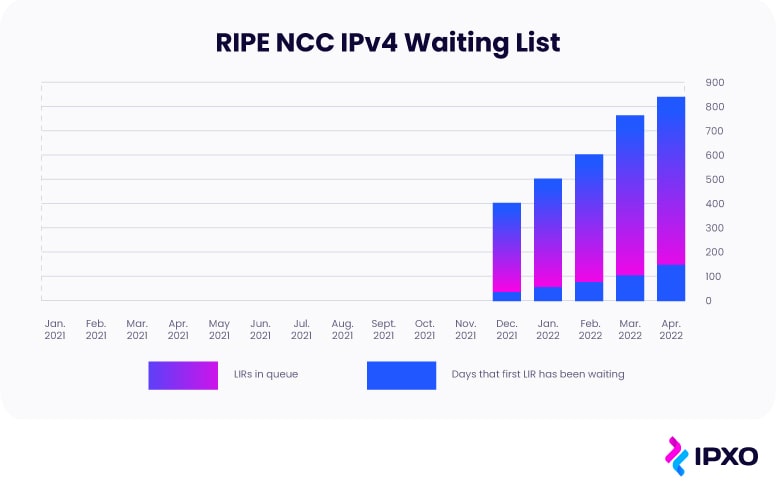

It is also interesting to note that the number of RIPE NCC-associated LIRs waiting in queue and the number of days that LIRs must wait have been increasing steadily since November 2021.

IPv4 leasing

IP leasing can solve several problems at once. First and foremost, companies with a surplus of IPv4 resources can monetize them and earn money without needing to find IP lessees or negotiate lease conditions. At the same time, companies that are in dire need of IP resources can lease them at low upfront costs.

At the time of publication, the average price deal per IPv4 address at the IPXO Marketplace was just $0.52 per month. This means that a /24 block could be leased for just around $133/month, a /23 block – $266/month and a /22 block – $532/month.

What’s more, IPXO lessees are not restricted when it comes to leasing IPs from specific RIRs. IPXO supports leasing from all RIRs, and clients can freely lease from IP holders in different regions without needing to untangle different policies and requirements.

IPXO’s LIR Services enable IP clients to lease, monetize and manage resources without needing an LIR account. With the help of Managed LIR Services, IPXO can help with IP announcements and routing services.

The variety of IPv4 addresses – 2 million and counting – available at the IPXO Marketplace ensures that clients can lease blocks of varying sizes from all five RIRs. And if clients cannot find exactly what they are looking for, the Waiting List feature enables them to submit a request that the IPXO Sales team handles quickly and professionally.

Moreover, IP leasing eliminates the responsibility of vetting IP holders or IP lessees, as all of that is done before clients can even join the Marketplace. Additionally, the Abuse Prevention team takes over 24/7 IP address monitoring to mitigate abuse on time. Undeniably, we take abuse observability seriously.

If you wish to learn more, check out what features the IPXO platform has in store.

Ultimate Guide to IPv4 Lease

Learn how to lease IPv4 with confidence

The future of the IPv4 transfer market

Ever since IPv4 addresses have become a commodity, companies around the world have been searching for ways to obtain this valuable resource. While some choose to join waiting lists organized by RIRs, others rely on brokers to help them buy the assets from IP holders that do not use them.

With the size of the internet expanding every day, the limited number of IPv4 addresses is becoming even scarcer. As a result of that, the prices of IPs are climbing as well. Unfortunately, companies that are looking to expand their operations might be struggling to cover the costs of both the raw resources and the additional transfer fees that might come with them.

While IPs are not an owned asset, the IPv4 transfer market enables companies to transfer exclusive rights to use IP resources. All transfers are public, which ensures the transparency and integrity of the entire market. That’s why we are always aware of odd transfers like when Pentagon transferred 175 million IPs to an unknown company.

The good news is that companies that cannot wait to obtain IP resources or amass the capital to buy and transfer IPs have options. They can quickly and easily acquire the IPv4 resources needed for their growth via leasing. The IPXO Marketplace offers great opportunities for both IP lessors (IP holders) and IP lessees to unlock unused IP addresses and put them back on the market.

In conclusion, the shortage of IPv4 addresses has impacted businesses globally, and two essential markets – the IPv4 transfer market and the IPv4 lease market – have emerged to help solve the problem and, hopefully, create a more sustainable and open internet. To learn more about your options with leasing, take the IPXO platform walkthrough.

About the author

Table of contents

What is the IPv4 transfer market and how did it emerge?

The beginnings of the IPv4 transfer market

How does the IPv4 transfer market operate across RIRs?

AFRINIC transfer market

APNIC transfer market

ARIN transfer market

LACNIC transfer market

RIPE NCC transfer market

Security risks are prevalent within the IPv4 transfer market

Why you should consider high IP transfer costs

Regional Internet Registry fees

IPv4 transferring comes with restrictions

Alternatives to IPv4 transferring

Waiting lists

IPv4 leasing

The future of the IPv4 transfer market

Related reading

IPv4 Waiting List Explained

What is an IPv4 waiting list? How does it work and who operates it? Is there a way to get IP resources without joining a waiting list? Uncover all…

Read more

Selling IPv4 Addresses? Here Are 3 Things To Consider First

IPv4 addresses have become a great asset in 2023. Do you want to sell IPv4 blocks? Here are a few things to consider first.

Read more

Buying IPv4 Addresses: Is It the Best Option for Growing Companies?

Have you faced IPv4 exhaustion? Do you believe you must buy IPv4 address space? Discover why you should consider IP lease as the alternative.

Read moreSubscribe to the IPXO email and don’t miss any news!