The Rising Value of IP Addresses as a Global Commodity

6 min read

16 October 2023

Dainius Lukšta

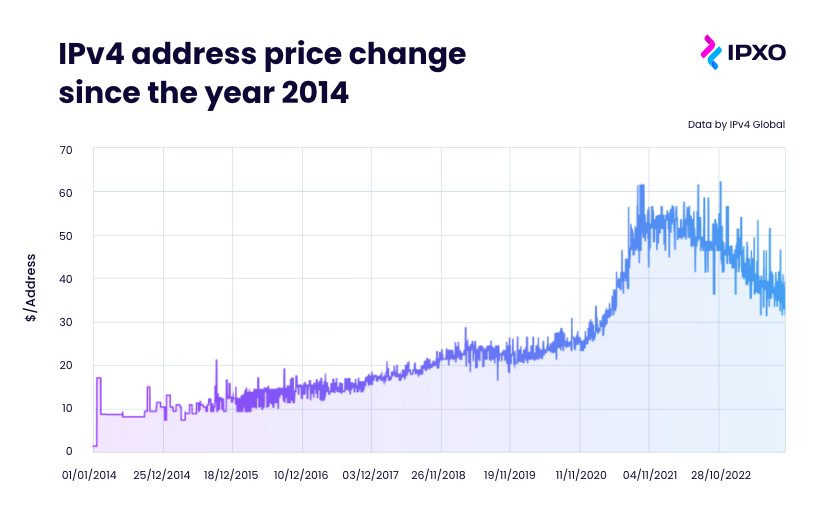

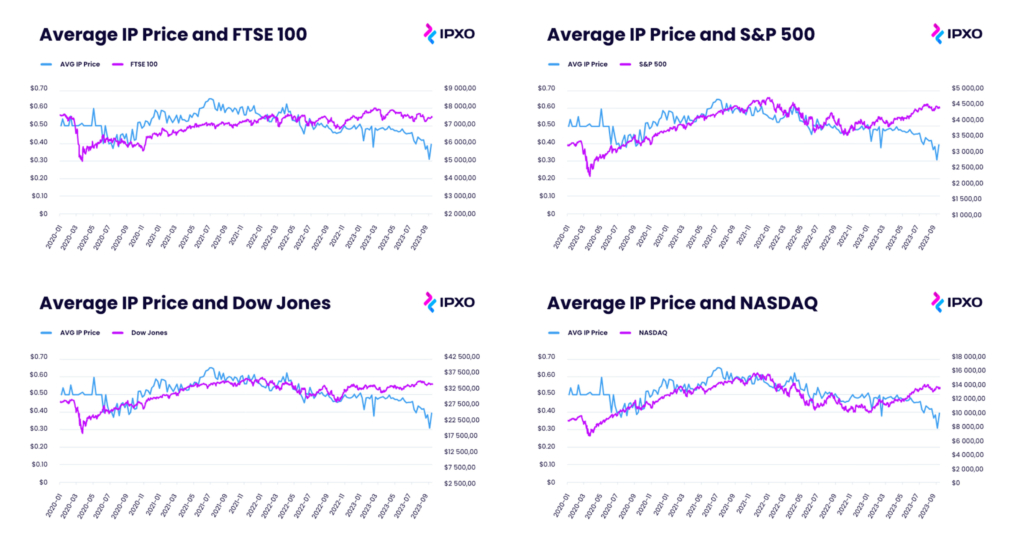

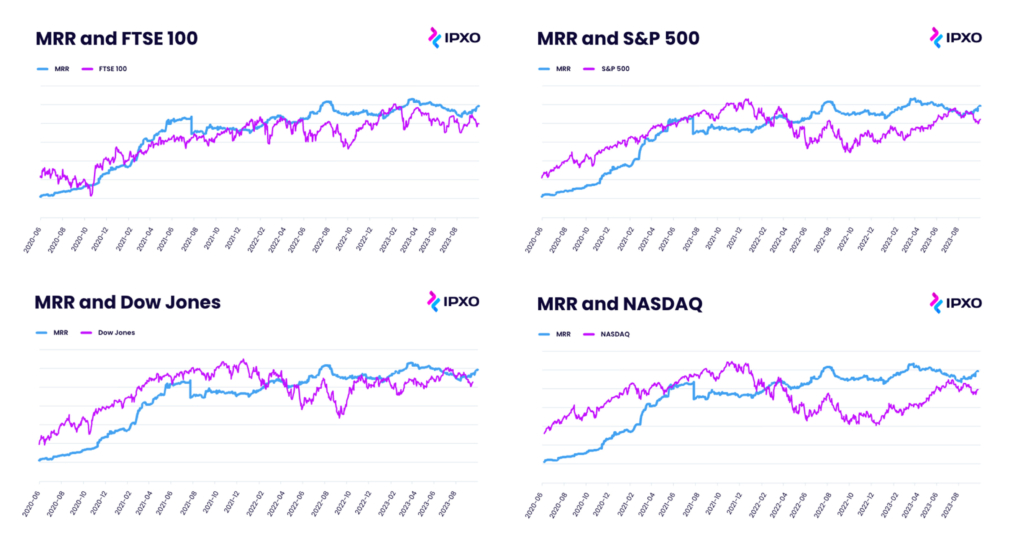

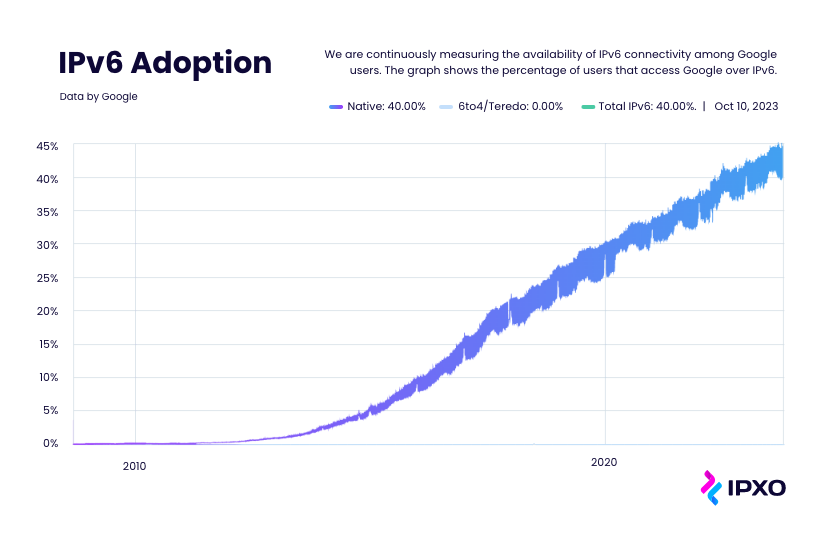

The interaction between IP address sale prices and the broader economic landscape not only emphasizes the perceived financial value of these digital assets but also uncovers a link between our role as an IPv4 provider and Monthly Recurring Revenue (MRR) and its relationship with stock market fluctuations. Explore this fascinating connection to learn more.

About the author

Dainius, with years of experience at IPXO, is a Chief Data Scientist known for his exceptional attention to detail and strong analytical skills. His expertise lies in precise data analysis, unearthing valuable insights, and consistently delivering accurate results.

Table of contents

Related reading

6 October 2023 •

IP Management

IPXO’s Transformation: From the IPv4 Shortage Problems to Network Resources Management

Explore IPXO's transformative journey from IP Marketplace to Next-Gen IPAM. Discover how our innovative solutions are shaping the future of IP resource management and promoting a secure, interconnected digital…

Read moreSubscribe to the IPXO email and don’t miss any news!