Home » Blog » IP Leasing

Are IPv4 Addresses a Commodity?

Do IPv4 addresses deserve the commodity status? Will IPv4 addresses remain a commodity in the future? Continue reading to learn all about it.

A commodity is an item, product or service that can be bought and sold, and, in that sense, IPv4 addresses have long been a commodity. As we define the IPv4 commodity status, it’s important to look at how IPv4 changed the world we live in just four decades since its introduction.

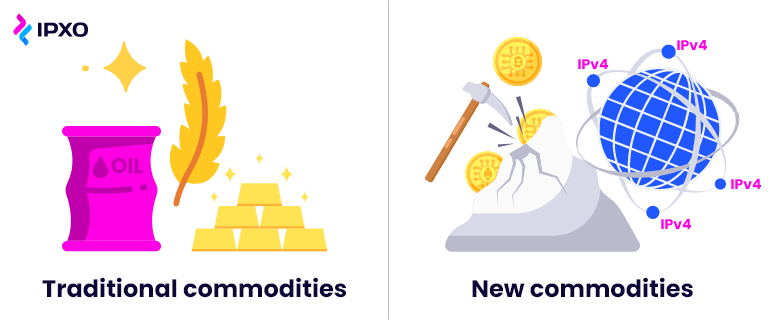

When the Internet Protocol version 4 emerged in 1981, even its creators couldn’t have predicted it would ever be compared to such traditional commodities as gold, natural gas or even wheat.

The unique thing about IPv4 is that it’s an intangible commodity. Similar to cryptocurrency, which has also emerged as a commodity in its own right, IP addresses exist in the digital realm. Nevertheless, the demand for these digital commodities is gaining momentum.

It’s undeniable that IPv4 addresses are becoming more and more desirable. But what exactly has led to IPv4 becoming a commodity? Will this resource remain a commodity in the near future?

How IPv4 addresses became a commodity

Scarcity directly correlates to the high demand that the low supply cannot support. That is why IPv4 addresses are starting to become a desirable commodity. Unfortunately, the IPv4 shortage is a major problem for internet users today.

Internet keeps expanding

When IPv4 came to life, fewer people had devices that required an internet connection. There were fewer people to begin with. However, even in the first decades of IPv4 existence, it was already evident that this Internet Protocol would not be able to support the entire internet forever.

This is why IPv6 was introduced. IPv5, officially known as the Internet Stream Protocol, did not exit experimental stages. IPv6, however, emerged in 1995. The creators of this Internet Protocol thought that it would replace IPv4 sooner rather than later. Twenty-six years later, IPv4 is holding its position as the standard Internet Protocol.

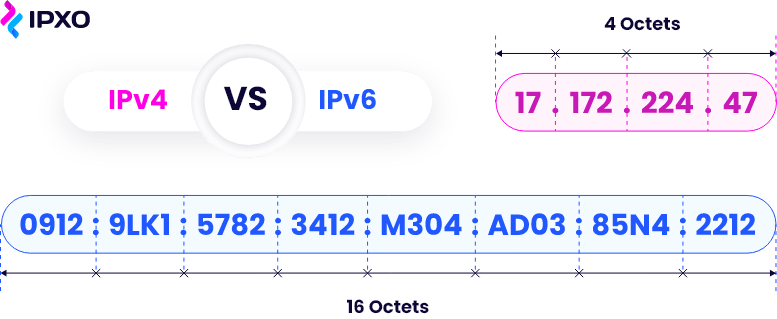

When comparing IPv4 vs. IPv6, it is clear that IPv6 offers great advantages. First and foremost, the infrastructure supports 340 undecillion IPv6 addresses. This is difficult to compare to the 4.29 billion IPv4 addresses. In theory, we will never run out of IPv6 addresses.

More internet-connected devices surround us than ever before. However, IPv6 adoption is not going according to plan. Ultimately, we cannot yet live without IPv4. Therefore, it is not surprising that this scarce resource is becoming a commodity.

IANA has allocated all free address space

The Internet Assigned Numbers Authority, also known as IANA, owns internet number resources, including IP addresses and autonomous system numbers (ASN). IANA emerged in 1988, and it took on the role of allocating IP addresses. Both IPv4 and, later on, IPv6.

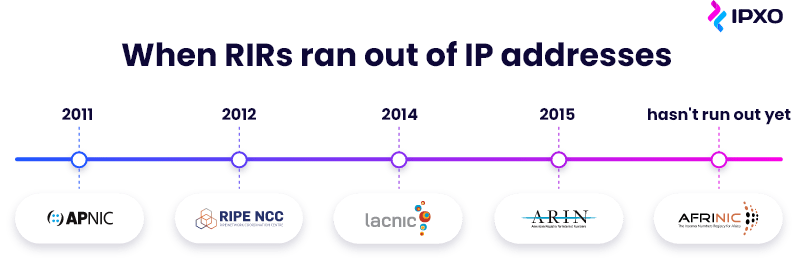

IANA doesn’t typically allocate IP addresses to end-users. Instead, it works with five Regional Internet Registries (RIRs): AFRINIC, APNIC, ARIN, LACNIC and RIPE NCC. RIRs have their own service regions. For example, ARIN operates in North America.

RIRs work with LIRs (Local Internet Registries). An internet service provider (ISP) can become an LIR. As a result, most end-users get their IP resources from LIRs.

IANA is responsible for the entire address space of 4.29 billion addresses, and its main task is to allocate these resources according to RIRs’ needs. However, in 2011, IANA officially stopped allocating IP addresses because the free address space was depleted.

For a while, some RIRs still had resources. Eventually, they ran out too. Except for AFRINIC, the RIR that serves the African region. According to Geoff Huston, APNIC ran out of IPs in 2011, RIPE NCC in 2012, LACNIC in 2014 and ARIN in 2015.

How are IP addresses allocated now?

RIRs no longer allocate resources directly from the pool of free IP addresses. Nonetheless, they continue to allocate IP addresses that are put back into the market or are transferred from other RIRs. How they manage this depends on unique and complex RIR policies.

ARIN, for example, only supports so-called micro-allocations to infrastructure providers. The allocations are no smaller than /24 blocks, which contain 256 IPv4 addresses. RIPE NCC also limits IPv4 allocation to one /24 block per LIR.

APNIC allocates /23 blocks to its members, and they can only request one block in total. Both AFRINIC and LACNIC support /22 – /24 allocations.

Overall, RIRs continue to allocate IP addresses, but the allocation policies are stricter than ever before. New members are also very limited in what they can request from their RIRs. Moreover, LIRs may have to join long waiting lists to get the resources they need.

How IPv4 addresses compare to other commodities

It can be challenging to compare tangible and intangible commodities and assess the value of each in our day-to-day lives.

More traditional commodities include soft (e.g., wheat or cocoa), energy (e.g., natural gas or crude oil), precious metal (e.g., gold or silver) and industrial (e.g., copper or aluminum) commodities. IP addresses and cryptocurrency are intangible commodities.

The value of these commodities depends on many factors. Naturally, the value goes up when the demand is higher than the supply. But what influences the higher demand? And how does the demand for IP addresses compare to the demand for other commodities?

IPv4 vs. the stock market

A stock is a collection of shares within a corporation. Each share indicates partial ownership within that corporation and the products or services it produces. The stock market is a public market where buyers and sellers can trade these shares.

According to Investopedia, there are several key events that influence the stock market:

- Political conflicts/wars

- Inflation and deflation

- New laws and policies

- Technological advancements

- Natural disasters

Needless to say, it is not always possible to predict when a drought will destroy the crops, or a political upheaval will cut off the global crude oil supply. This is why investing in traditional commodities has always been risky and somewhat unpredictable. In short, it is a gamble.

Let’s look at the stock price history of two companies in two completely different markets.

Walmart Inc.

Walmart is the largest company in the world by revenue. The company’s shares have gone from $0.3 (USD) in October 1981 to $140.55 in October 2021. The US-based international retailer has 10,524 physical stores in 24 countries that are also supported by online shopping platforms.

Walmart sells groceries, electronics, clothing, beauty products, sporting goods, homeware and a variety of other products. In short, it offers a one-stop shop, which may be where the success of the company lies. Walmart’s stock price history reveals that the company’s stocks reached an all-time high during the Covid-19 pandemic.

Norwegian Cruise Line Holdings Ltd.

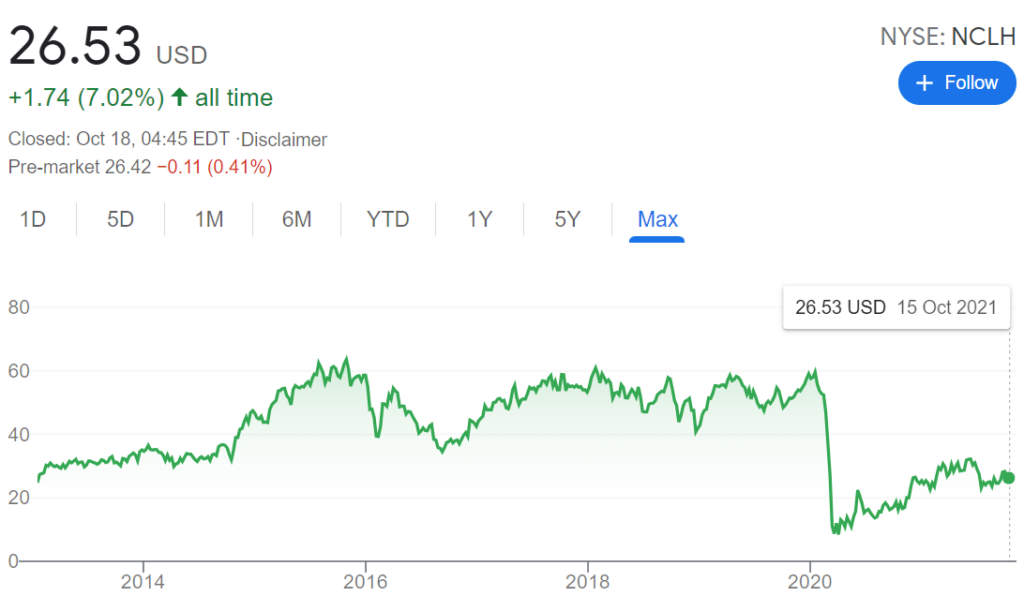

It’s easy to interpret NCLH’s stock price history. The company went from $59.65 per share in January 2020 to $8.72 in March 2020. As the world was shutting down due to the emerging cases of Covid-19, we stopped traveling.

Norwegian Cruise Line Holdings was founded in Norway in the 1960s. Before the pandemic, NCLH was the third biggest cruise line in the market. While Walmart’s shares might have gone up because people were only shopping for essentials, NCLH’s shares went down exactly because of that.

How do IPv4 and stock markets compare?

Needless to say, stock trading is a complicated process that requires a deep dive into the market, global politics, unique government-level policies and numerous other factors.

So, how do stocks compare to IPv4 addresses? Both are driven by supply and demand. If the supply is low and the demand is high, the prices go up. In the opposite scenario, the prices normally go down.

On the other hand, it does not look like political disruptions or natural disasters impact the IP address market as significantly as the stock market.

What about the technological advancements that can influence stock prices? If IPv6 adoption speeds up, this will be a technical advancement directly influencing the IPv4 market. However, that is not something we expect to happen any time soon.

IPv4 vs. gold

Gold does not tarnish, and there’s enough gold in the world to make it a tradable commodity. Yet, producing gold is not easy, and you are unlikely to have much luck panning for gold nuggets.

Humankind has also attached an emotional value to gold. Traditionally, wedding bands are made of gold, and this commodity has been a symbol of wealth for thousands of years.

The first golden coins date back to the 8th century BCE in Asia Minor. While gold could have been used in trading long before that, this is when gold became a real currency. Gold remains a currency to this day.

While we don’t carry golden doubloons in our wallets today, we can buy bullion bars and items made of pure gold, including wedding bands and other kinds of jewelry.

Although this traditional commodity has been around for thousands of years, it hasn’t lost its value. In fact, the graph below reveals that gold prices have grown 2639% since the 1970s. In 1973, you would have paid around $63 per ounce of gold. Today, the price is $1,771 per ounce.

How do IPv4 and gold markets compare?

While we know for a fact that we’ve run out of free IPv4 addresses, we cannot know when we might run out of gold. That said, gold mining continues to be increasingly more difficult. The so-called easy gold has been mined, and today’s mining requires better equipment and more highly trained professionals. As a result, less gold is extracted at a much higher cost.

Similar to stock prices, the prices of gold correlate to whatever is happening in the world. In 2019, 2,195 tonnes of gold were in demand. However, in 2020, that demand fell to 2,044 tonnes. As expected, in March 2020, the demand for gold decreased, and the prices dropped as well. However, that didn’t last.

In August 2020, gold prices reached a decade-high of $2,070 per ounce of gold. Unlike stocks, gold is considered a safe and stable investment, and people turn to gold when in crisis. During the Covid-19 pandemic in 2020, 16% of Americans invested in gold, and another 23% considered investing in this commodity.

Are IPv4 addresses the commodity that people will invest in when things get tough? Considering that an average global citizen doesn’t own or need to own IP addresses, that will not be the case. On the other hand, most people need IPv4 addresses, unlike gold.

Ultimately, as both gold and IPv4 addresses are increasingly more difficult to get, the prices of both are likely to continue growing too.

IPv4 vs. cryptocurrency

Cryptocurrency is a digital currency that emerged in 2009. It wouldn’t work without the blockchain, a system that keeps all cryptocurrency-related records, including user identities and transactions. Everything is encrypted to ensure privacy and security.

Cryptocurrency is facilitated by crypto mining. This is not the same kind of mining that gold producers need to manage. Instead, crypto mining employs high-power computers to solve cryptographic equations. As computers verify data and add records to the blockchain, their owners earn cryptocurrency as a reward.

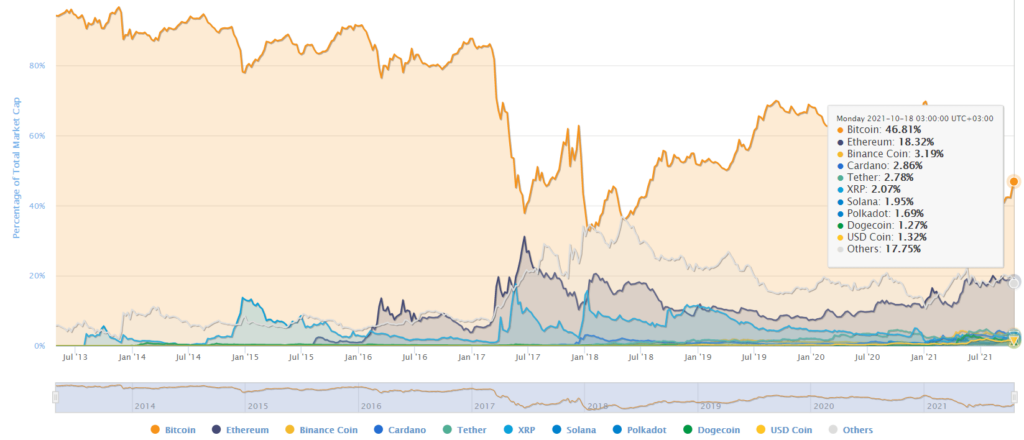

According to CoinMarketCap, there are close to 7,000 cryptocurrencies. The top 10 in October 2021 were Bitcoin, Ethereum, Binance, Cardano, Tether, Solana, XRP, USD Coin, Dogecoin and Polkadot. Let’s look at the price histories of Bitcoin and Ethereum.

Bitcoin (BTC)

Bitcoin is the first decentralized cryptocurrency in the world. It emerged in 2009, and it continues to be the most popular cryptocurrency. Some believe it will always remain the number one crypto in the market.

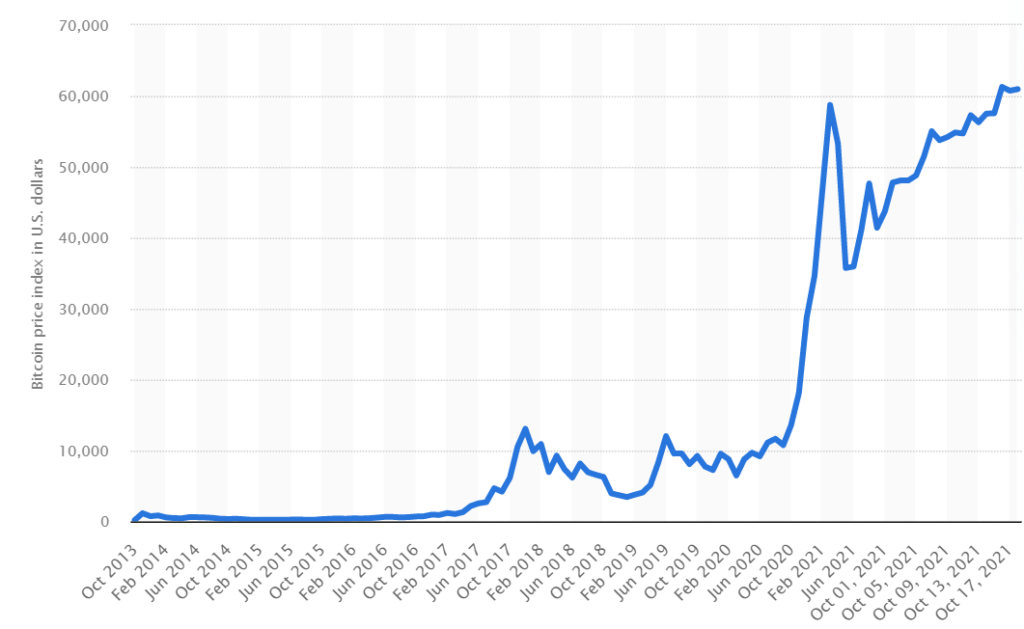

According to Statista, Bitcoin prices reached an all-time high in March 2021, when 1 BTC was worth $58,734.48. This is an impressive jump from the low $196 per BTC in October 2013. In October 2021, the prices grew even more to $61,273 per BTC.

In March 2020, Bitcoin prices dipped slightly, but they bounced back to the February rates the following month, indicating that the global Covid-19 outbreak didn’t affect the prices much.

So, what affects Bitcoin prices? Yet again, we need to remember the demand and supply rule. When more people are buying Bitcoin, the prices automatically go up. That said, cryptocurrency price changes aren’t always predictable.

For example, when El Salvador declared Bitcoin a national currency, global prices went down 17% that same day. The effect of that – $400 billion gone. What gives? It’s possible we can blame the Chivo Wallet that enables El Salvadorians to make crypto transactions. The app could not support the growing number of users, and as it was down, the Bitcoin purchases halted.

Ethereum (ETH)

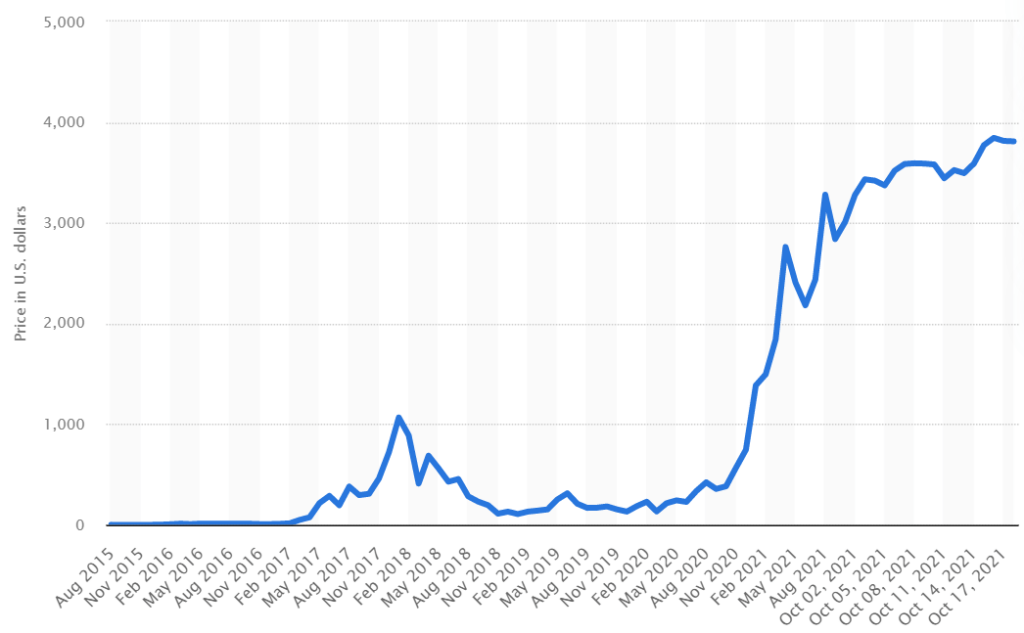

Ethereum emerged in 2015, six years after Bitcoin. However, it quickly became one of the most important cryptocurrencies in the world.

According to Statista, although Ethereum started with $0.66 per ETH in 2015, the resource was worth $3,844 per ETH in October 2021.

Like other cryptocurrencies, Ethereum is decentralized, meaning that it is not dependent on a central bank. Due to this, the prices are directly correlated to the general demand. Like prices of Bitcoin and other cryptos, Ethereum’s prices go up when the demand is high.

If you were to compare Ethereum and Bitcoin markets, the former is much more unpredictable and unstable. Because of that, people tend to invest in Bitcoin more, which is why it is the number one cryptocurrency in the world.

How do IPv4 and crypto markets compare?

Although crypto has been around for more than a decade, communities around the globe don’t have a unified view of this commodity. In September 2021, El Salvador became the first country to adopt Bitcoin as a national currency. At the same time, China declared that all cryptocurrency transactions are illegal.

The global internet community, on the other hand, agrees that IPv4 is essential. While many are pushing for quicker IPv6 adoption due to the advantages of this Internet Protocol version, the common consensus is that IPv4 is the backbone of the internet today.

Furthermore, we have nothing else to compare IPv4 to other than IPv6. We know the advantages and disadvantages of both, and there’s not much room for interpretation here. That is not the case when we discuss cryptocurrencies.

While all seven thousand cryptocurrencies have unique attributes, they all offer the same product. The competition is immense, which is not something we can observe between IPv4 and IPv6 at the moment.

Undoubtedly, competition influences price changes in the market, which, in theory, should ensure quicker innovation and more stable prices. Nonetheless, Bitcoin is still at 46% of total market capitalization. Ethereum has never passed 31% and reached only 18% in October 2021.

While Bitcoin doesn’t have a monopoly over the entire market, its competitors have always been behind.

To sum up, no one questions the importance of IPv4. The only competitor is IPv6; however, we know that the adoption of this Internet Protocol has a long way to go. That said, IPv4 is limited, whereas cryptocurrency is not. And while investors may choose to put their money towards cryptocurrency due to that, the crypto market is still quite unstable and unpredictable.

Will IPv4 addresses remain a commodity in the future?

We’ve discussed a few different types of commodities, and we compared them to IPv4 addresses. Now, we know the benefits of IPv4 versus other commodities. But are IPv4 resources worth investing in?

Here are the main reasons why some choose IPv4 over other commodities:

- IPv4 addresses are unanimously valued around the world

- Today’s internet cannot exist without IP addresses

- Dependency on IPv4 addresses keeps growing every year

- IPv4 shortage drives high demand, which drives price acceleration

- No competition, except for IPv6, which has a long way to go to catch up

- IPv4 address prices do not seem to be affected by political or natural calamities

- No production costs involved; unlike, for example, in gold or crude oil markets

- IPv4 resources help build a more sustainable internet

20% of IPv4 addresses remain unused

According to IPXO’s data analysts, almost 370 million IPv4 addresses have been transferred throughout the years. The number is likely to grow even more by the end of this year. That means that around 22 total /8 blocks of IPv4 addresses have been transferred. That is more than 8.6% of the total IPv4 address space.

High IPv4 transfers indicate the shortage of resources because when there were enough IPs, intra- and inter-RIR transfers were not a thing. Today, RIRs no longer have free IP addresses to allocate, which means that the market is slowly becoming dependent on transfers.

Considering that around 20% of IPv4 addresses remain unused, it makes sense to put them back into the market. So, why do IP holders choose to keep IP addresses to themselves? Some may be waiting for IPv4 sale prices to go up even more so that they could sell their resources at a higher markup. Others may not know how valuable IPs are.

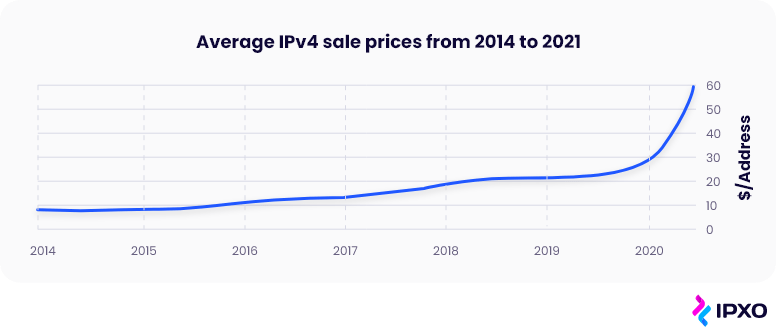

To answer the question of whether or not IPv4 addresses will remain a commodity in the future, we need to look at the IPv4 price history.

How did IPv4 prices change?

Our data analysts continuously track the IPv4 sale market and the changes within it. That is how we make predictions and judge the IPv4 lease market. According to our research, the lease market is behind by around 6-8 months. This means we can see the future of the IPv4 lease market just by looking at sale prices.

As we look at the historical data, it is evident that IPv4 prices tend to rise predictably. Between 2014 and 2017, the average sale price was around $15 per IP. In 2018 and 2019, the price rose to $20/IP, on average. The following year, we saw a jump to around $25/IP. Today, in 2021, the prices range from around $44-50/IP. However, sales of $60/IP have been publicized as well.

Clearly, the growth of IPv4 sale prices is accelerating. Why is that so? The market is narrowing down with fewer and fewer IPv4 addresses available. However, the demand has not diminished. On the contrary, it has only increased. What does that mean? We are confident that both IP sale and IP lease prices will continue to go up.

IPv4: A stable commodity

If you compare the IPv4 sale price graph to the graphs representing the prices of stocks, gold and cryptocurrency, you can see that IPv4 address prices are climbing much more steadily and predictably.

For how long can the increase of IPv4 sale prices be sustained? That is a million-dollar question that no one can answer. In theory, when IPv6 adoption reaches a certain point, IPv4 addresses will no longer be a necessity. If that happens, the prices will stabilize. Will they stop increasing, or will they fall? That depends on the level of IPv6 adoption.

So, when will IPv6 catch up to IPv4? When IPv6 emerged, it was supposed to replace IPv4. That hasn’t happened yet. At this point, it is impossible to predict when, or perhaps even if, IPv6 will replace IPv4.

In October 2021, IPv6 adoption among Google users reached 37%. This number may not seem small; however, it is uninspiring, considering that IPv6 has existed for nearly three decades. Of course, IPv6 adoption rates vary from country to country. For example, India leads with 63% of IPv6 adoption nationwide. However, on a global scale, full adoption may be decades away.

In the meantime, as IPv4 continues to support the internet, sale prices per IP address keep going up. Therefore, we believe that IPv4 addresses will maintain the commodity status in the foreseeable future.

Should you hold onto, sell or lease IPv4 addresses?

As IPv4 sale prices continue to grow, it’s only natural that lease prices follow suit. As we discussed earlier, it is possible to predict the trajectory of IPv4 lease prices 6-8 months in advance. And the current prediction is that lease prices will keep rising.

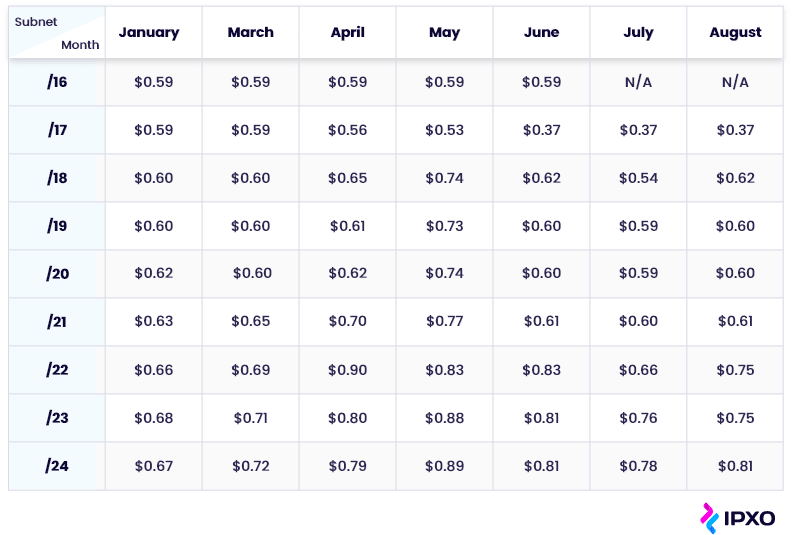

As detailed in our IPv4 price history report, the current IPv4 lease prices range from $0.37 to $0.90 per IP. The price depends on the subnet block size and also minor fluctuations within the market itself.

Buying vs. selling IPv4 addresses

What you do with your assets is a very personal decision. You might find reasons to sell IP addresses, or you might feel inclined to monetize. What about holding onto IPv4 addresses?

From one perspective, it might make sense to hold onto IP addresses, given that IPv4 sale prices are likely to go up in the future. However, if that is your strategy, holding onto IPs without monetizing them in the meantime doesn’t make much sense.

IPXO Marketplace, the world’s first fully automated IP monetization and lease platform, supports both lessors and lessees. If you add your resources and monetize them at the desired prices, you automatically unlock a reliable revenue stream. At the same time, reputable lessees acquire the resources they need to build and scale their businesses. It’s a win-win situation.

Well, isn’t selling IPs more profitable than leasing them to third parties. In the long run, not at all. In fact, it takes less than a year to earn more from leasing than selling. Ultimately, monetizing IPv4 addresses offers a fairly quick return. More importantly, it offers a continuous return.

You can use IPXO’s Leasing vs. Selling Calculator to compare the revenue you would attain by selling and leasing your IPv4 resources. Be aware that the tool does not take into account the standard 5% platform fee for IP holders deducted monthly from earned revenue.

IPv4 addresses gain attention

Tangible and intangible objects cannot seem to become commodities without attracting the attention of criminals. Gold is smuggled, stock fraud has been around for decades and money laundering has firmly set foot in the crypto world.

The IPv4 market has attracted criminal activity too. The underground black market is booming, and resources are traded illegally. Furthermore, BGP hijacking/IP hijacking continues to threaten the reputation of IP holders and, at the same time, their resources.

Nonetheless, IPv4 addresses are becoming a hot commodity. It’s not hard to understand why. After all, there is a shortage of IPv4 addresses, a highly valued resource in today’s world.

Moreover, at this point, IPv4 address prices are quite predictable. As you analyze and look at historical data, it is clear that prices rise steadily with only minor dips followed by rises.

Overall, IPv4 addresses are sought after, their prices are predictable, and the value does not seem to be affected by the same factors that affect the more traditional commodities. These are the reasons why IPv4 is becoming a commodity worth monetizing and investing in.

About the author

Table of contents

How IPv4 addresses became a commodity

Internet keeps expanding

IANA has allocated all free address space

How are IP addresses allocated now?

How IPv4 addresses compare to other commodities

IPv4 vs. the stock market

Walmart Inc.

Norwegian Cruise Line Holdings Ltd.

How do IPv4 and stock markets compare?

IPv4 vs. gold

How do IPv4 and gold markets compare?

IPv4 vs. cryptocurrency

Bitcoin (BTC)

Ethereum (ETH)

How do IPv4 and crypto markets compare?

Will IPv4 addresses remain a commodity in the future?

20% of IPv4 addresses remain unused

How did IPv4 prices change?

IPv4: A stable commodity

Should you hold onto, sell or lease IPv4 addresses?

Buying vs. selling IPv4 addresses

IPv4 addresses gain attention

Related reading

Top 10 Benefits of Leasing IP Addresses for IP Holders

Explore the top 10 benefits of leasing IP addresses with IPXO. Maximize income, protect your IP resources, and gain full control.

Read more

Opinion: IP Leasing Should Become a Market Standard

Learn why IPv4 leasing should become a market standard, which would bring many benefits in a more competitive environment, leading to additional revenue for all parties involved.

Read more

The Ultimate Guide to IPv4 Lease for IP Lessees

IPv4 lease enables companies to scale networks without purchasing expensive IPs and spending additional resources on IP management and IP reputation monitoring. Discover how to lease IPs with ease…

Read moreSubscribe to the IPXO email and don’t miss any news!