Home » Blog » IP Leasing

IPv4 Price History

IPv4 sale and lease market prices change constantly. Take a closer look at how these prices changed throughout the years, what impacted these changes and what we can expect in the future.

As you run through the comprehensive IPv4 price history data in this post, you can clearly see the changes within the market that took place. We have a clear turning point with the official IPv4 address exhaustion and the first big trades in IP resources. Then we have the shift that came with the expanding IPv4 lease market.

Back in the early 1980s, when IPv4 was just emerging, IPs were free and handed over to anyone that requested them. This is how, at the time, big organizations – like Microsoft, Hewlett-Packard and Xerox – received large blocks of IPv4. Pretty quickly, poorly managed allocation of the valuable resource became evident, and in 2011, companies were forced to start selling and buying IPs.

Ultimately, although it is commonly accepted that IPv4 has been exhausted, there are still plenty of unused assets that can be reassigned. Unfortunately, due to increasing scarcity, buying IPs is becoming more expensive by the year – a major burden for companies worldwide. Fortunately, IP leasing has emerged as a solution for both IP holders and companies that simply cannot or do not want to spend millions of dollars on limited internet numbers.

Buy IPv4 vs. Lease IPv4 Costs

Compare prices using our FREE calculator

In this report, we analyze the changes within the IPv4 market. We also look at the value of selling IP addresses. Finally, we discuss the potential of securing a recurring revenue stream without losing the IP holder’s rights.

When did we run out of IPv4 addresses?

IPv4 resources have become a commodity, and that is because we ran out of IPs much quicker than expected – around 2011, to be exact.

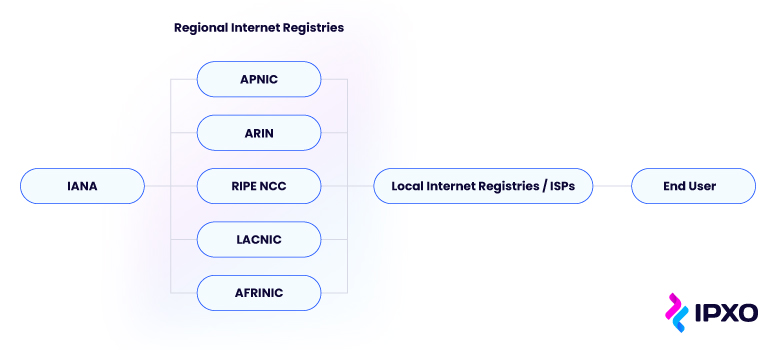

The Internet Assigned Numbers Authority (IANA) exhausted its free pool of available resources in 2011. The organization divided the available address space according to the Regional Internet Registries’ (RIR) needs up until that point. Although it no longer has new IP addresses to spare, IANA is still responsible for the global coordination of the IP addressing systems and autonomous system numbers (ASN).

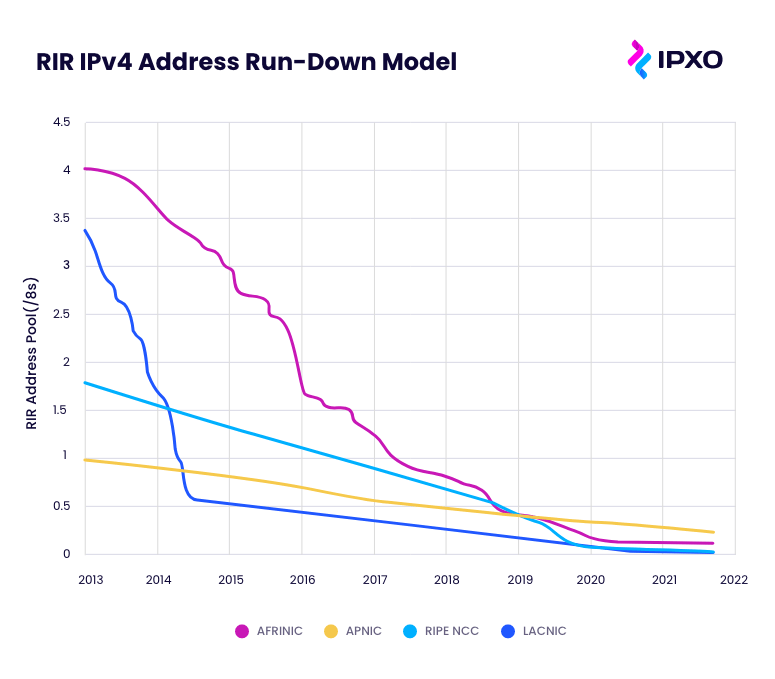

According to Geoff Huston, APNIC – the RIR of the Asia-Pacific region – was the first to run out of allocated IPv4 addresses in 2011. Other RIRs followed suit: RIPE NCC (Europe and parts of Asia) in 2012, LACNIC (South America and parts of the Caribbean) in 2014 and ARIN (North America and parts of the Caribbean) in 2015.

AFRINIC entered the so-called IPv4 exhaustion phase 2 at the beginning of 2020, and is also nearing the full depletion of the resources allocated by IANA. Therefore, the RIR now limits its allocations to /24 – /22 subnets.

APNIC allocates /23, while ARIN supports micro allocations of /24 to organizations that transition to IPv6. LACNIC is awaiting recovered and returned addresses so that it can re-allocate them to the waiting list members. RIPE has also introduced a waiting list.

The challenges of buying IPv4

IP addresses enable all internet-connected devices to communicate. That includes servers, desktop computers, smartphones, printers, smart home cameras, smart TVs and so on. The good news is that regular internet users don’t need to buy IPs or even configure them.

Internet service providers (ISPs) operate by allocating IPs to their customers, and ISPs get their resources from the RIR operating in their geographical region. IANA, as you now know, is responsible for splitting the entire IPv4 address space among RIRs.

Companies hoard IP addresses

Needless to say, internet service providers, cloud providers, IoT companies, hosting providers and companies of all sizes need IP addresses to run and also scale their networks. One company may choose to buy IPs because it may require greater control over their networks. Another company may have security concerns or simply may not have enough information about the financial value of resources that are in high demand but limited supply.

The problem here is that quite a few companies hoard IP addresses seemingly without a purpose. Some may not value the potential of unused assets, and others may not understand it altogether. While, in theory, we have run out of new IP addresses, around 20% (49 /8 blocks) of global IPv4 resources remain unused. This could help many companies interested in scaling with IPs.

According to IPXO’s VP of Strategic Sales, Paulius Judickas, the IPv4 price grew by almost 250% between 2020 and 2021. He added:

Judickas also added that since 2018, the IPv4 lease price has almost tripled, which directly correlates to the IPv4 sale price. According to IPXO’s data, there’s a 6-8 month gap between the increase of the IP sale price and the increase of the IP lease price.

Big companies purchase IPv4 addresses

In 2011, Microsoft obtained 666,624 IPv4 addresses from Nortel, a Canadian telco that went bankrupt. The company paid 7.5 million US dollars (7.3 million Canadian dollars at the time), or $11.25 per IP address, which was not a small price to pay in 2011. By this time, it was already clear that IPv4 addresses were running out rapidly, and Microsoft’s purchase indicated that changes were coming to the IPv4 market.

In 2017, Google purchased the entire /12 block, consisting of 1,048,576 IP addresses. Amazon was also an active buyer in the period between 2017 and 2019. According to reports, the company purchased 8 million IPv4 addresses from MIT, 16 million from General Electric and 4 million from AMPRNet.

At an average IPv4 price of $15-25 per IP at the time, Amazon could have paid close to $420-700 million. Today, the same resource could go for as much as $45-60 per IPv4 address, which means that a buyer would need around $1.2-1.7 billion to cover the cost. In short, in just a few years, the IPv4 price has more than doubled. This perfectly illustrates how quickly IPv4 addresses have become a desirable commodity.

Joining an RIR waiting list: Is it a good alternative?

While companies can use IPv4 brokers to handle IP transfers and connect IPv4 address sellers with buyers, they can also choose to obtain IPv4 addresses directly from an RIR. In this case, the company becomes a member of an RIR and, potentially, enters a waiting list. This means that this company has to wait for IPs that the RIR reclaims during a re-allocation or transfer.

The issue here is that waiting lists are long. So long that, in fact, you might have to wait years to get even a small allocation of IPv4s. For example, in January 2023, the first ones in line to receive IPs from ARIN and RIPE NCC waited for more than 300 days. According to LACNIC’s calculations, the last one to join their waiting list will have to wait until 2029. Most companies are unwilling to wait that many years, and so they turn to buying IPs. This is when they face the challenge of high IPv4 pricing.

Needless to say, for smaller and medium sized businesses, paying for IPs is a huge undertaking. For companies that do not have endless budgets, paying for IPv4 means cutting down in other areas. This is one of the struggles that, for example, cloud providers are dealing with: How to cut down cloud spending without compromising growth.

Fortunately, it is easy to lease IPv4 and grow without investing your entire budget into IPs!

What influences the IPv4 selling price?

The IPv4 price continues to grow each year, and while you might have purchased one IP for around $5-10 a decade ago, today, you would have to allocate from $45 to $60 for the same resource.

Several key factors influence the global IPv4 sale price:

- Supply and demand are out of balance

- The transition to IPv6 is slower than expected

Supply and demand imbalance

There are over 5 billion internet users worldwide. How significant is this? Well this number has surpassed the total number of IPv4 addresses – 4.29 billion unique IPv4 addresses in total. Of course, when the IP version 4 emerged in the 1980s, this seemed like an abundant number of resources for many years to come.

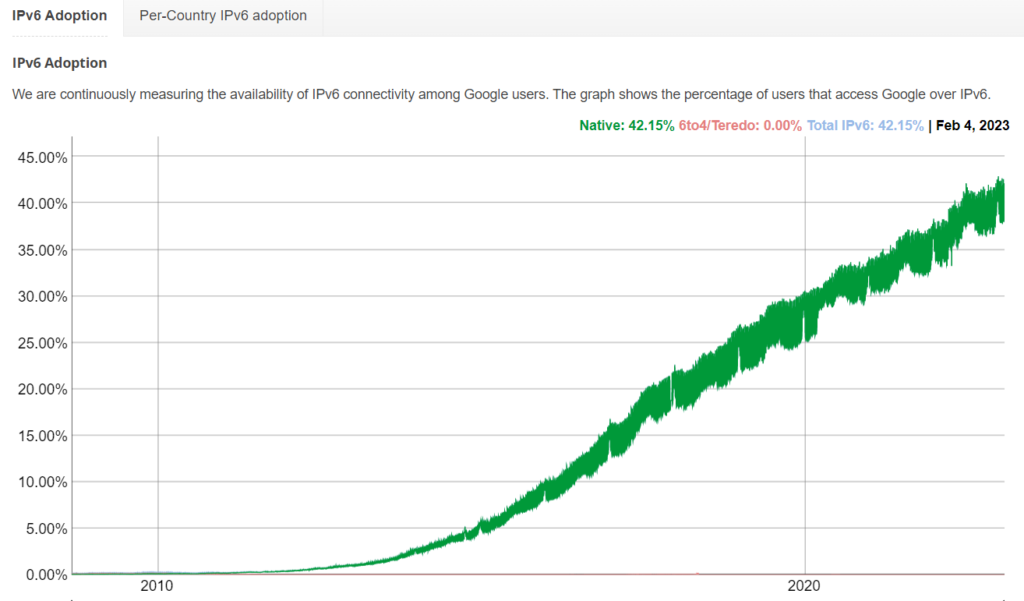

Internet architects quickly learned that the limited number of IPv4 addresses would run out much quicker than anyone could have imagined. The Internet Stream Protocol, which is famously known as IPv5, never left the experimental phase. However, IPv6, introduced in 1995, seemed to offer an excellent alternative. Nonetheless, IPv6 adoption rates have been disappointing.

Slow IPv6 adoption

The IPv4 vs. IPv6 debate is gaining more traction these days, but it is evident that IPv4 will continue to be the backbone of the internet for the foreseeable future. Why is that so? First and foremost, IPv4 manages to satisfy the needs of users. Network Address Translation (NAT) plays a huge part in this.

Every internet-connected device requires a unique IP address, but there are more than 4.29 billion devices in the world. NAT consolidates multiple private IPs into fewer public IPs, which helps conserve the limited IPv4 addresses.

Moreover, IPv6 network adoption requires immense resources. Replacing equipment, training IT teams or hiring IPv6 experts and transitioning users is not appealing to companies that are still fully functional without IPv6. Even some internet service providers aren’t ready for the shift.

Mobile network operators are definitely leading in IPv6 adoption. According to some reports, Verizon and AT&T are at 80% of IPv6 adoption, and T-Mobile is nearing 100%. Nonetheless, IPv6 connectivity among Google users data shows that IPv6 adoption globally barely crossed the 40% mark.

How do IPv4 transfers work?

IPv4 address transfering indicates the move of the resource from one entity to another. An IP holder – who is either a Local Internet Registry (LIR) or the end-user represented by one – can request a transfer. Request procedures differ, depending on individual RIRs’ policies.

We can take RIPE NCC as an example. This RIR requires that transfers operate between LIRs and end-users that LIRs sponsor. IPv4 addresses cannot be transferred for 24 months if received from the RIR, transferred from another organization or after a merger/acquisition.

RIPE NCC supports inter-RIR transfers; however, it does not support trading until both involved RIRs approve it, and, as you already know, different RIRs have different policies. Furthermore, RIRs have different relationships.

RIPE NCC only facilitates IPv4 transfers with ARIN, APNIC and LACNIC. All four RIRs have inter-RIR compatible policies, but AFRINIC does not support that. Naturally, inter-RIR transfers are not possible between AFRINIC and the other four RIRs.

It should come as no surprise that transferring IPs comes with a price. For example, when transferring resources from LACNIC, an administrative fee between 1,000-1,500 US dollars (depending on the size of the subnet) is applicable.

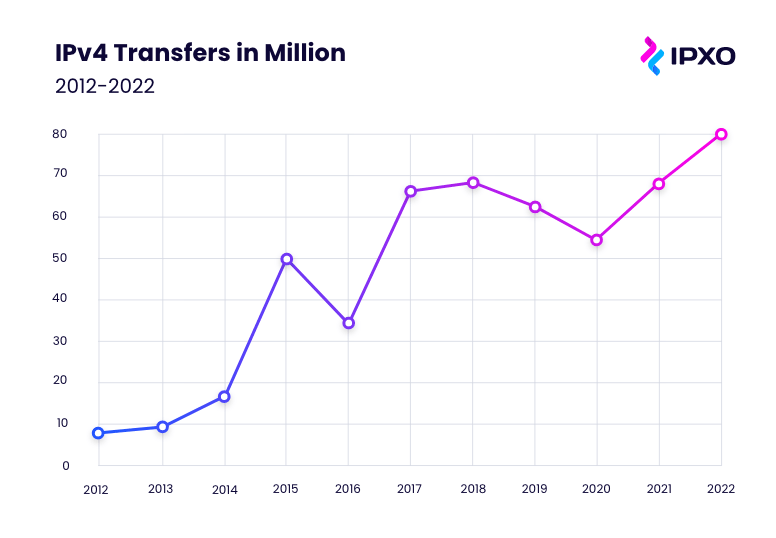

Between 2012 and 2022, more than 500 million IPv4 addresses were transferred, including transfers related to mergers and acquisitions. Amazon alone acquired 126 million IPs between 2011 and 2022 through transfers. Overall, IPv4 assets are moving between entities quite vigorously, which impacts both IPv4 sale and Pv4 lease prices.

IPv4 sale price history overview

Comprehensive historical data on global IPv4 prices or IPv4 transfer deals throughout the years doesn’t exist. Such data is simply not revealed by RIRs, LIRs and the IP brokers. Nonetheless, some trading information has been made public. Therefore, we can piece together the details we have to make up the bigger picture.

You could have bought a single IPv4 address for around $10-15 in 2017. The average price for IPv4 grew to around $15-20 in 2019. According to our statistics, /24, /23 and /22 blocks were the most popular and sold at the higher prices at the time. If sold at $20 per IP, the blocks were worth $5,120, $10,240 and $20,480, respectively. Not too shabby for something intangible.

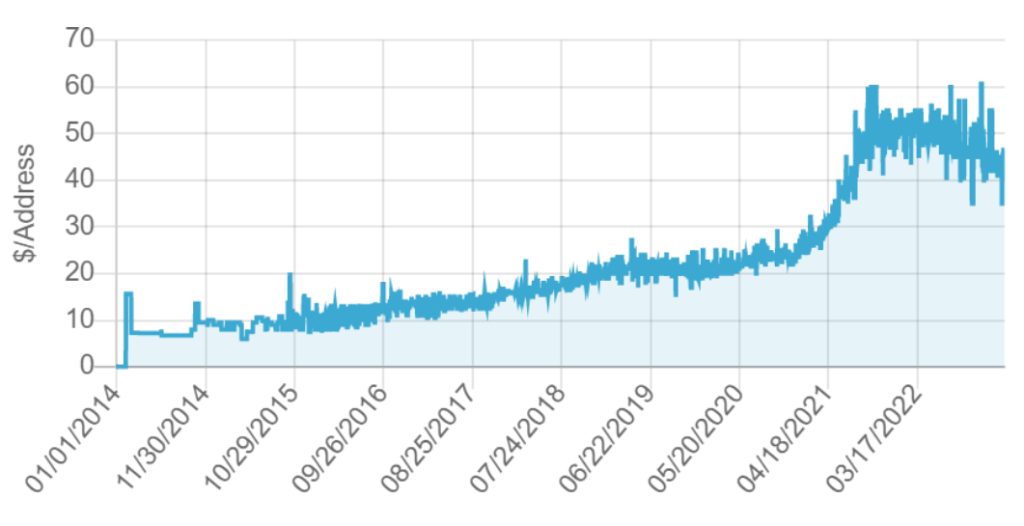

According to the historical data accumulated by Hilco Streambank’s IPv4 brokerage division, the IPv4 price has risen significantly within the last decade. The graph below shows the average IPv4 price in USD between 2014 and 2022.

From $6 to $60 in under a decade

According to the data of this single IPv4 brokerage, the IPv4 sale price went up from around $6-24 per IP in 2014 to $23-60 per IP in 2021, depending on the subnet size. The differences between the lowest and highest sales per IPv4 were relatively modest up until 2021 when significant jumps started occurring.

In 2021, the highest sale prices per IPv4 address were recorded in September and October. The IPs allocated by RIPE NCC and ARIN were sold for $60 a piece. RIPE NCC allocations were sold for $15,360 for the entire /24 block, and ARIN’s allocations were sold for $61,440 for the /22 block and $30,720 for the /23 block.

In October 2022, IP brokers sold assets allocated by ARIN for $60.70 per IPv4 address ($15,540.00 for the entire /24 block) – the largest sale of the year. Overall, the IPv4 price seems to have stabilized. At least compared to the more abrupt IPv4 price changes observed in 2021.

You can find historical IP sale data from 2014 January to 2022 December in the table below. The data represents allocations from different RIRs and both lowest and highest prices per IPv4 in blocks /24-/15.

Unsurprisingly, the biggest sales are associated with the /15 subnet – the biggest block (131,072 IPs) in the available data. Two /15 blocks allocated by RIPE NCC were both sold for $7.47 million in August 2022.

It’s important to note that this data represents IP sale information from one independent IPv4 brokerage. Moreover, we cannot determine the administrative fees that could have been part of the publicized sales. Ultimately, IPv4 brokerages set and control their own prices.

Needless to say, this is just one piece of the puzzle that IPXO analysts use to get a clear picture. While we look at this data with a grain of salt, it helps us understand the state of today’s IPv4 market and the IPv4 value overall.

Market prices: Leasing IPv4 vs. selling IPv4

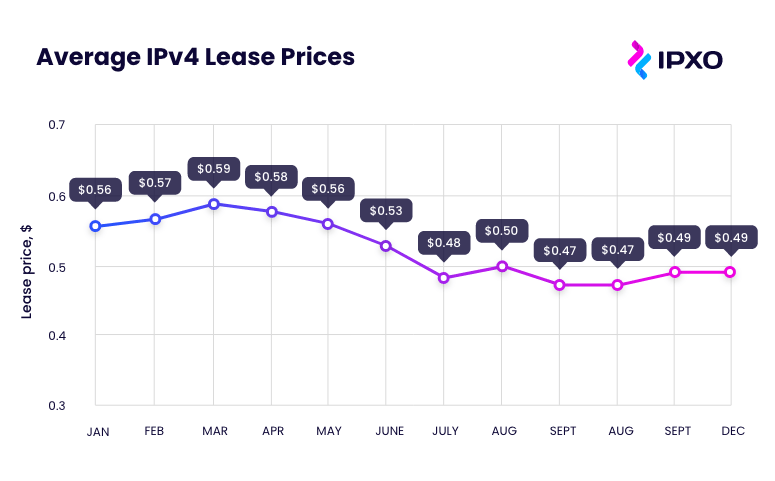

As you now know, the IPv4 lease price directly correlates with the IPv4 sale price with a delay of around 6-8 months. Considering that the sale prices were quite predictable and stable in 2022, it is not surprising that IPv4 lease prices were also relatively predictable and stable throughout the year.

Of course, as in any market, fluctuations are anticipated. The average lease price at the IPXO Marketplace ranged between $0.46 and $0.59 per IP address in 2022, but the price ranges are much more distinct when we look at different subnet sizes specifically. To get a more detailed view of the data, check out the first of its kind IPXO Statistics hub.

The downside of selling IPv4

As the IPv4 price continues to go up due to the shortage of resources and sluggish IPv6 adoption, some IP holders are, literally, holding onto their assets in the hopes of making more money in the future. That said, there are a few issues associated with selling IPs. The biggest of them being that when you sell, you are signing up for a one-time deal.

Even though IPv4s were once free, the scarcity has created a secondary market, in which unused resources are put back into rotation for a fee. At the end of the day, someone is always willing to pay for the assets they request and need. And we know very well that IPv4 addresses are in high demand.

According to the IPXO revenue calculator, the average price per IP, at the moment, is $50. Let’s say you want to sell your /24 subnet, which is the most popular in the lease market. The /24 subnet contains 256 IPv4 addresses. Therefore, if the lease cost per IPv4 address is $44, you could earn $12,800. Please keep in mind the 5% platform fee for IP holders that is deducted monthly from earned revenue.

All in all, if you sold your assets, you would lose the recurring revenue potential, yield gains and the rights to use the resources as a legitimate holder. On the other hand, if you chose to lease your IP addresses, you could retain those rights and secure recurring revenue and yield gains.

IPv4 lease benefits

According to the revenue calculator, you could make more money by leasing your IPs instead of selling them in just under a year. The good news is that, currently, there’s no limit to how long you can lease your assets. Sure, IPv6 adoption may speed up; however, the demand for IPv4 resources is unlikely to halt any time soon.

Overall, leasing IPv4 is beneficial in more ways than one:

- Unlock a new revenue stream by setting the desired prices

- Empower IP lessees to start scaling their operations

- Alleviate the global IPv4 exhaustion

- Contribute to the growth of the sustainable Internet Protocol ecosystem

Ultimately, even if you decide to give up your IPv4 resources one day, there’s no point in keeping them idle today. It has never been easier to monetize IP addresses and create a stable revenue stream.

The dark side of the IPv4 world

Whether you choose to sell or monetize IPv4 addresses, you have plenty of options to do it safely and legally. Unfortunately, not everyone is willing to play by the rules.

The black market is booming

Anything that is in high demand eventually attracts shady business. Unsurprisingly, the IPv4 black market is growing, and IP holders need to protect their resources more than ever before.

In 2019, Amir Golestan from Charleston, S.C., managed to obtain 757,760 IP addresses from ARIN just so he could sell them on the black market. The US Department of Justice charged Golestan on twenty counts of wire fraud.

According to the Department of Justice, the number of IP addresses obtained by Golestan could have been worth between $9.8-14.4 million ($13-19 per IP address). ARIN uncovered the fraud when it found that numerous bogus companies obtained small blocks of IPv4 and then resold them to third parties.

That same year, reports emerged suggesting that AFRINIC resources worth 1.3 billion ZAR were stolen and sold on the black market. Shockingly, the theft was an inside job.

Unprotected IP address blocks are at risk

The black market often relies on the use of hijacked IP addresses. Hackers perform BGP hijacking to corrupt internet routing tables and take over IPs. The hijacked resources go to malicious parties, who may exploit them for spamming and other malicious activities.

Spamming is not only annoying or potentially dangerous. The biggest concern is that if a hijacked IP address is used for spamming, the reputation of that IP may be tarnished. That is because when suspicious or malicious activity is associated with an IP address, it is blocklisted. IP blocklisting is a kind of IP filtering system that, in most cases, is set up to filter email traffic.

With the IPv4 price at an all-time high, IP-related security issues require close attention from everyone involved. That includes cybersecurity experts, IP address holders, internet service providers, RIRs and also those who help manage IP resources.

At IPXO, a professional Abuse Prevention team ensures top-level abuse management services and 24/7 support. Real-time IP address monitoring and daily IP health checkups are set up to maintain IP reputation and keep customers – both lessors and lessees – safe.

The future of IPv4 prices

The size of the internet may not be limitless, and as the global population expands and the number of connected people grows, the IPv4 address space becomes smaller and smaller. While we await wider adoption of IPv6 in the future, today, we have to find ways to make do with the resources that are available to us.

According to historical projections, IPv6 should have replaced IPv4 by now. Clearly, that hasn’t happened yet. That is, largely, thanks to Network Address Translation technology. All in all, it is difficult to say how quick (or slow) IPv6 adoption will be, but we believe that IPv4 will continue to be the backbone of the internet for many years to come. Quite possibly, throughout the entire 2020s, too.

Once IPv6 catches up to IPv4, we should see IPv4 sale and lease markets stabilizing. For now, however, both sale and lease prices are on the rise. While selling IPv4 resources might seem like a good option, data and numbers show that, at this time, monetizing IPs by leasing them is more profitable than selling IPs. In fact, it may take just under one year to attain greater revenue compared to a one-time sale.

At IPXO, we support companies in numerous industries interested in monetizing their unused IP address space, enriching the current market and helping smaller businesses around the world scale with the help of IPv4 resources. If you are interested in joining the IPXO Marketplace, your fully automated IP address lease & management platform, register today!

About the author

Table of contents

When did we run out of IPv4 addresses?

The challenges of buying IPv4

Companies hoard IP addresses

Big companies purchase IPv4 addresses

Joining an RIR waiting list: Is it a good alternative?

What influences the IPv4 selling price?

Supply and demand imbalance

Slow IPv6 adoption

How do IPv4 transfers work?

IPv4 sale price history overview

From $6 to $60 in under a decade

Market prices: Leasing IPv4 vs. selling IPv4

The downside of selling IPv4

IPv4 lease benefits

The dark side of the IPv4 world

The black market is booming

Unprotected IP address blocks are at risk

The future of IPv4 prices

Related reading

Top 10 Benefits of Leasing IP Addresses for IP Holders

Explore the top 10 benefits of leasing IP addresses with IPXO. Maximize income, protect your IP resources, and gain full control.

Read more

Opinion: IP Leasing Should Become a Market Standard

Learn why IPv4 leasing should become a market standard, which would bring many benefits in a more competitive environment, leading to additional revenue for all parties involved.

Read more

The Ultimate Guide to IPv4 Lease for IP Lessees

IPv4 lease enables companies to scale networks without purchasing expensive IPs and spending additional resources on IP management and IP reputation monitoring. Discover how to lease IPs with ease…

Read moreSubscribe to the IPXO email and don’t miss any news!