IPv4 Monetization: How To Determine the IPv4 Subnet Price on the Marketplace

5 min read

1 December 2022

Agnė Srėbaliūtė

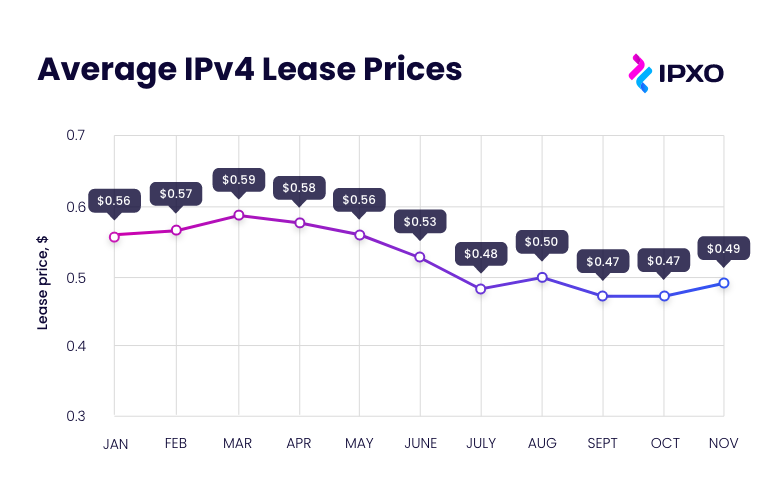

Whether you have already started monetizing your unused IPs on the IPXO Marketplace or you are still trying to figure out what IP prices you should set, there are a few things to consider.

About the author

Agnė is a Technical Content Writer at IPXO. For more than 15 years she has been molding her skills in various fields, including PR copywriting, SEO copywriting and creative copywriting. Her lifestyle is based on continuous learning through numerous areas of interest, leisure activities and travelling. Addictions? Hiking and coffee.

Table of contents

Related reading

26 July 2022 •

IP Monetization,

IPv4 for Business

The Role of IPv4 Broker in the IP Address Market Explained

What is an IP address broker? What is their role in selling and buying IPs? How can you acquire IP resources quicker and cheaper without IP brokers? Continue reading…

Read more

1 June 2022 •

IP Monetization,

Product Updates

IPXO Platform Payouts Explained

What are IPXO payouts? How do they work? How to set them up? Here are the answers to all of these essential questions.

Read more

How IPXO Adopted RPKI

The Resource Public Key Infrastructure is an essential security framework that ensures safe routing. Learn how IPXO has implemented RPKI at the IPXO Marketplace.

Read moreSubscribe to the IPXO email and don’t miss any news!